Two legislative interventions according to property succession and you can landholding liability into accessibility property from the private nearest and dearest is critical for all of our study. These types of interventions are the Intestate Succession Rules 1985 (PNDCL 111) and also the Lead from Relatives Responsibility Legislation 1985 (PNDCL 114) , having potential importance to homes accessibility, as well as actually during the level of the smallest relatives device. Inside arrangement, control of the house reverts from private control (of the ily just like the a business tool . listed you to no person can be allege best possession in order to such as for instance an excellent residential property. It is but not argued that when the family serves as an effective collaborative group, the household unit while the homes stored because of the family unit members once the commonwealth could be used given that buffers against stressful transitions [75,76], together with enabling an associate to use the fresh new home since equity defense having loans. In such a case yet not, it’s important to negotiate the latest standards and requirements of each friend [77,78].

Considering the divided reputation into implications regarding home period registration courses regarding the literary works fundamentally, so it paper tries presenting skills regarding the Dagbon personal system within the Ghana so you can explicate the situation on to the ground. This comes after from the realisation you to inconsistencies were popular in the the fresh conversion process books [79,80], with effects based on how programmes to possess regional home membership work well in various personal formations. In this regard, analysing how stars contained in this some other personal possibilities get excited about home period registration programs as well as the implications of their wedding are helpful. This new key interest associated with papers try thus to understand more about this new characteristics and you may fictional character from urban property places on the Dagbon urban area in northern Ghana, as well as how they food in making use of various residential property-situated resource tool. Specifically, we concentrate on the ability from landed property to add availableness to borrowing and you will financing financing throughout the housing strategy.

4.1. Studies urban area description

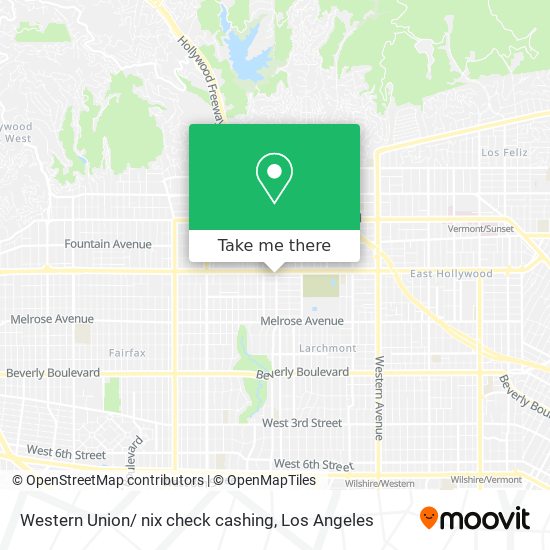

The research is used regarding Tamale Urban Urban area (TMA) (come across Fig. step 1 ). Tamale is the local capital of your own North Area for Ghana. The new native individuals of Tamale are definitely the Dagomba ethnic class which for years and years formed among the many oldest kingdoms in the region titled Dagbon, having its old-fashioned Overlord within the Yendi. Tamale, the principal city of the latest Dagombas, ‘s the third-prominent area in Ghana and you can a growing spot to own investment inside the Western Africa. Tamale functions as the latest administrative and you can industrial hub to the Northern Part and increases since large urban, monetary, social, governmental, and you can monetary financial support of your own Northern Part (come across Fig. step one ). The metropolis center off TMA computers several local, regional, and you will worldwide banking institutions and various around the globe and you may regional nongovernmental companies. Dagbani is the local language of Dagbon.

To get over this complications, the fresh literature signifies that a sustainable homes capital system is critical [, , ]. Particularly a studio is additionally even more demanding during the Around the world Southern area nations such as for instance Ghana, where emigration on the locations possess overwhelmed casing establishment, ultimately causing sprawling slums [13,14]. Even if obtainable borrowing options enjoys generally come acclaimed just like the a great driving force in making sure sustainable housing plans, some things about the minimal move regarding financial credit to help you home and you will agencies could have been a composition in different scientific tests during the such nations. During the Ghana the difficulty could have been properly recognised. Aryeetey seen brand new difference within reluctance off loan providers in order to generate credit offered as the houses and you will enterprises largely run out of adequate appropriate equity to support its finance. Readily available analytics demonstrate that, inside the Ghana, an estimated 79% out-of small and 83% out-of brief-measure organizations try borrowing from the bank restricted, in contrast to 62% and 68% correspondingly in Malawi (ibid.:164). Therefore, when you look at the a breeding ground in which potential investors use up all your equity to help with credit to shop for construction systems, personal coupons, attempting to sell off property, and you will remittances from household members abroad have become an element of the-remain regarding financial support for individual housing structure and you can sales [several,16]). Due to the ineffective money elevated from the provide, quite often it requires over ten years accomplish the fresh framework of 1 possessions [several,17].

cuatro. Content and methods

The task out-of gives help compared to that doctrine. Certainly one of most other steps ,talks about how the Government from Chicken working construction financialisation using the fresh new legislation; carrying out monetary structures one increased conjecture because of the residential and you will around the world capital with the homes and you may property since possessions; enclosing personal house and exploiting relaxed sorts of tenure; making property out-of property and homes from the development cash-sharing urban regeneration tactics; and using coercive judge and you may penal force so you’re able to outlaw casual advancement, and to inhibits resistance to condition-added development work.

Just what looks lost during the early in the day knowledge might have been the latest mini-height, effects regarding loved ones-assist financial arrangements, and having fun with intra-members of the family investment because the equity within the acquiring financing having funding. In reality, within the custoily-assist financial arrangement are a technique which had been used in many years when you look at the antique sectors during the Ghana while in the times of individual otherwise family you prefer. Even after the newest promulgation of your Intestate Succession Laws, 1985 (PNDCL step one 111) , experience suggests that Ghanaian group will most likely not stick to the arrangements out-of the latest Intestate Rules in dealing with the newest notice-gotten assets of a dead dad, fearing it would evaporate their residence installment loan bad credit online Alaska. Particular families like keeping the house or property inside a pool toward entire family, especially in happening out-of property. This might be especially the situation if piece of property bequeathed is relatively smaller than average usually do not easily be mutual except by the promoting this new residential property and you will submitting new continues. Although not, publishing including house is problems in north Ghana, in which Total Fertility Speed is actually large, and you can polygyny ‘s the standard . Polygynous gadgets with different uterine household indicate a top dependency ratio. The prospect one to fragmentation of the house in such circumstances you will devalue the monetary significance prompts parents to save particularly possessions for the the new pond. The latest regarding certified banking strengthened the classic accessibility such as for example assets.

Following this position, the and, after , analyses off assets are key field theories inside their support into individualisation away from assets within moral constraints . These concepts preceded people arguing the brand new sheer inevitability regarding individualisation while the better just like the those people with the monetary advisability out of individualisation. Talking about, but not, opposed to well-known property theorists who do not find individualisation because the a stimulant to own creativity.

It can be clear regarding literary works examined that, no matter if numerous scholarly really works might have been over into the the subject of home as the guarantee, there is certainly hardly any work especially exploring intrafamily short tools (also polygynous group having uterine units) and how making use of the latest commonwealth is discussed within the support of men and women seeking utilize this household members property because the guarantee getting finance. Certainly most other considerations, the objective of this study thus will be to explore the fresh ins and outs throughout the negotiation of commonwealth because the guarantee for people, just how that is shown, and you can what are the results in case there is default from loan fee and you will what is actually completed to recover the brand new told you possessions.