Financial Ideal Upwards: Best method To get to know The necessity for Additional Financing

A couple of times once availing off a mortgage and having repaid the brand new monthly premiums for a few many years, you might need more money to address individuals construction dilemmas. Or you could need certainly to merely renovate your house. In such cases, as opposed to obtaining a fresh financing, you can go for a top Right up Financing on your established financial. This is a less strenuous and smaller way to arrange the desired money.

The top Upwards Mortgage meaning means that it is that loan you to financial institutions provide to the current home loan consumers. Certain banks bring a premier Right up Financing simply for housing-associated criteria.

How come a premier Right up Mortgage Works?

After you make an application for a home loan the very first time, you have got certain home loan eligibility that you can use. If you have burned up the loan limit, you aren’t qualified to receive a new loan straight away; not, for those who have reduced a few of the loan plus income has increased, your loan eligibility could have enhanced throughout the years. When this occurs, youre eligible for a high Right up Mortgage and additionally your current home loan.

However, your loan qualification alter just as time passes has passed. Which explains why, usually, finance companies allows its established mortgage users in order to use a Most useful Right up Mortgage merely shortly after 6 to one year out of paying the previous loan. Aside from it, there are numerous tips having being qualified. Being rating a leading Right up Mortgage, you truly need to have good installment record. The lending company has the final state, so your overall history and connection with the financial institution is along with affect the decision. The purpose where you you desire a high Up Loan is and additionally taken into account.

Greatest Upwards Financing Interest levels

When compared to mortgage brokers, Better Right up Money has a top interest rate. He or she is frequently thought to be an educated solution to new fund which have interest levels between 13.5 to help you 16 percent. The eye pricing at the top Upwards Money may differ dependent on the borrowed funds count you find on lender.

Qualifications having a top Upwards Loan

Financial institutions determine home loans based on the property’s ount try deeper than simply 30 lacs, capable give up to 80% of loan amount. Banking institutions is only going to approve a premier Up Loan if it is you’ll to extend significantly more borrowing in Mortgage in order to Worth construction. That is when it is as much as 80% of property’s market value. They will certainly contemplate the monthly EMI after you have drawn our home loan, in addition to repaired duty so you can income ratio for the Better Up Mortgage immediately following deducting this new installments of your own most recent mortgage.

Are there Restrictions To your A leading Upwards Financing?

Financial institutions just build like financing offered once six-12 months or a couple of years from sufficient fees into an excellent mortgage. In advance of such a loan is out there, particular banking companies could possibly get impose an extra position of achievement/palms of the property

Several banking companies ount, that is, the sum total Best Upwards Financing and the the house mortgage shouldn’t exceed the original mortgage sanction amount

Brand new period is bound towards amazing loan’s a great period. If you have 8 ages leftover on your mortgage, the term of your Greatest Up Mortgage will not be stretched than 8 age

Top Right up Online calculator

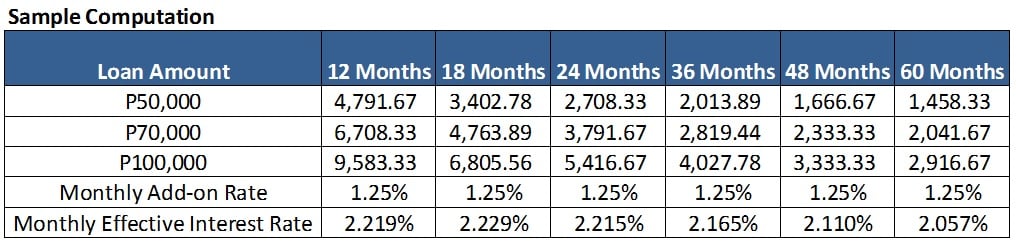

You must keep in mind that financial institutions base its loan calculations in the business value of the home. In the event your property is really worth over Rs 29 lakh, banking institutions in the Asia merely lend 80% otherwise a reduced amount of their market price. You should also have a good credit score to adopt the additional duty. Immediately following accounting for the ongoing house loan’s Equated Monthly Instalment (EMI), banking companies will determine the level of the top Up Loan. You may also look at the qualification to possess a premier Upwards Financing having fun with a leading Up Online calculator on the banks’ and HFC’s websites. The big Up Online calculator commonly instantly make it easier to determine the EMIs, based on the rate of interest, period, and you may loan amount requisite.

The bank have a tendency to assess your Ideal Right up Financing Fixed-Obligation-to-Income proportion (FOIR) after deducting the brand new repayments for all your powering obligations.

In short, a leading Upwards Mortgage was a better choice than your own mortgage. For those who have a mortgage while having a clean and you may a reputation percentage before, you have got a better risk of providing a top Up Mortgage. You can also find good ount for those who have already done 3-cuatro many years of your property financing cost. Because certain financing interest rates can range regarding 18 to 24 per cent, it usually is a smart idea check that to consider Greatest Right up Mortgage.