- Evidence of identity

- Proof of address

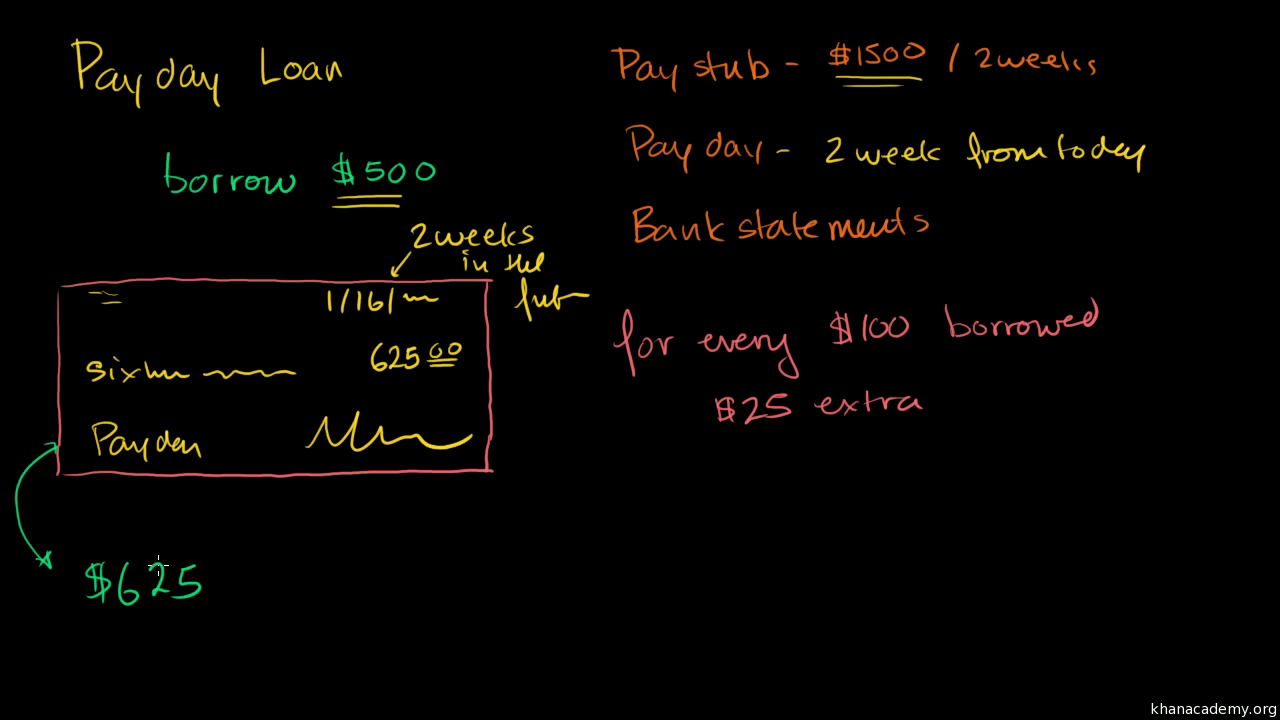

- Income documents

- Property-relevant documents.

- Recent income slips

- Lender statements

- Setting sixteen also it Returns

- Taxation productivity

- Profit and loss comments

- Current Membership Comments

Approval and you may Disbursement Process

The new acceptance and you may disbursement processes to own HDFC lenders are successful and buyers-friendly. Since the expected documents are filed and you may confirmed, the bank assesses the newest applicant’s creditworthiness and the property’s well worth. When the everything is under control, the loan is eligible, and approve letter try provided. Disbursement pursue the signing of the financing agreement and also the submitting out of blog post-old cheques otherwise ECS mandates for EMI repayments, establishing the very last help while making homeownership an actuality.

This new HDFC Financial Financial EMI Calculator was a valuable device to have possible homebuyers. It allows profiles to determine Kansas City installment loans bad credit their monthly EMI in accordance with the loan amount, mortgage tenure, therefore the fixed interest. By providing a definite picture of the fresh monthly financial commitment, it calculator assists within the think and budgeting, making sure individuals helps make informed ount and tenure without the unexpected situations down-the-line.

Exactly how Home loan Hand calculators Can help you

Financial hand calculators are crucial inside delivering a very clear comprehension of the brand new monetary ramifications off a home loan. They assist in determining the new affordability from fund available with calculating the latest month-to-month EMI, that is influenced by the loan count, interest, and loan period. It foresight aids in financial believe, making it possible for individuals to modify its amount borrowed or tenure to fit their fees capability, making sure a soft borrowing sense.

Mobile Your home Financing: HDFC Mortgage Harmony Import

Move your current home loan to HDFC may cause extreme discounts, specifically if you are availing off a diminished interest rate. The process is easy, made to feel hassle-free, and will be offering immediate economic masters.

Knowing the Benefits associated with Harmony Transfer

The house Mortgage Equilibrium Move into HDFC is sold with multiple masters, also probably down interest rates, most readily useful services words, and you can customized cost solutions. Consumers can easily gauge the advantages of the house loan import processes owing to a simple on the web app, making sure a seamless changeover to raised loan words.

Processes and needs to own Home loan Transfer

Moving a home loan to HDFC pertains to a definite and you may sleek techniques, making certain readers can switch the established home loan for possibly down rates and better provider conditions. People have to earliest get a zero-objection certificate off their current bank and offer in depth documentation regarding its established loan, also installment history. A credit assessment then pursue, similar to a different financial application, to assess the latest applicant’s qualifications not as much as HDFC’s standards. This transfer techniques is designed to end up being consumer-friendly, aiming to dump the economic weight and offer enhanced loan upkeep possibilities.

Making the most of Your home Mortgage

Promoting the many benefits of your residence mortgage relates to teaching themselves to perform they effectively. Envision choices for example Finest Upwards Loans for further needs at competitive rates. Getting told in the interest rate changes and you may offered harmony transfer selection having finest rates is also somewhat feeling the loan tenure and you may focus commission.

Strategies for Effective Mortgage Government

Energetic mortgage management begins with timely EMI money. Making use of the HDFC Bank on the web portal to possess overseeing your loan, and work out costs, and you can checking comments can streamline the method. From time to time examining the loan policy for people opportunities to get rid of focus pricing or reduce the loan period can save currency over the years. Remaining a virtually vision on the financial health and and make alterations as needed guarantees your property financing suits your greatest.

Additionally reviewing and examining their HDFC Mortgage Statement Online is plus help in keeping your updated having where you stand during the your home mortgage travels.