Posts

The institutions having part offices have to fill in the fresh survey; associations with just a central vogueplay.com proceed this site workplace is actually exempt. MMFs had been in addition to energetic people on the loans given because of the Government Mortgage Banks (FHLBs), boosting its holdings out of FHLB financial obligation securities from 9% to a dozen% away from total money assets in the 1st quarter from 2023. MMFs knowledgeable cumulative inflows away from $step one.dos trillion within the 2023, the biggest for the list. U.S. money industry finance (MMF) is a significant supply of quick-name funding for the financial system while they dedicate large cash balance and you will keep primarily quick-label investment.

Part 482.—Allowance of money and you will Deductions Among Taxpayers

Returns for the half a dozen-week licenses is attained for the a straightforward (perhaps not material) interest basis and are paid back when the certification grows up. We ranked Quontic Lender Certification from Deposit very to discover the best three-seasons Dvds as the its three-year certification pays step three.25% APY—probably one of the most competitive prices for that identity solution. Quontic’s rates for the all conditions try near the better productivity readily available, and the online bank makes it easy to open up an excellent Cd in minutes. Large much time-name productivity to the First National Financial’s Dvds may be right for those people trying to protected income more very long periods.

Bidding for Silicone polymer Area Individual Financial and you may SV Bridge Financial finalized on the March 24. The brand new FDIC acquired 27 estimates from 18 bidders, along with bids under the entire-lender, individual bank, and you may asset collection alternatives. On the March 26, the new FDIC recognized First-Citizens Lender & Trust Team (First-Citizens), Raleigh, North carolina, while the effective buyer to visualize all deposits and you will money from SV Link Financial. The fresh 17 former twigs of SV Bridge Financial in the California and you can Massachusetts reopened since the Earliest-Owners to the February 27.

$step 1 Deposit Local casino Information

Group in the Panel and the Set-aside Banking institutions make a wide list of logical works one to explores the state of the newest You.S. bank system with a certain work on growing threats that is built to render framework to have policymakers and you may staff (comprehend the “A lot more Subject areas” section). A look at each other internal and external matter means that group identified an array of growing issues, for instance the impact from rising interest rates to your ties valuation and you will potential put impacts, both of and therefore turned-out related for SVB. SVBFG’s rapid failure is going to be connected to the governance, exchangeability, and interest risk-administration inadequacies. An entire board out of administrators don’t discover enough guidance of management in the risks from the SVBFG and you can didn’t hold administration responsible. Such as, guidance condition one to management delivered the newest board didn’t appropriately emphasize SVBFG’s liquidity points until November 2022 even with extracting criteria.

Brand-new revealing. Brave journalism. Brought to your.

Basically, the new remuneration can be considered to be paid whenever a composed statement including the tips is actually provided to your employer by worker pursuant to area 6053(a), as the discussed below. step 1 Pursuant to help you § 433(h)(3)(A), the next section rates calculated less than § 430(h)(2)(C) is used to choose the most recent accountability away from a CSEC package (which is used to assess minimal quantity of an entire funding limit lower than § 433(c)(7)(C)). One put of cash, the function from which is to support the performance of a good domestic local rental arrangement otherwise people element of such as a binding agreement, besides in initial deposit which is solely a downpayment away from book, will likely be governed because of the terms associated with the section. (1) The newest created declaration itemizing the reason why for the storage of every portion of the defense put have to be with a full commission of your difference between the protection put and the amount employed. The newest landlord will spend not less than four percent annual attention to the people destroy, security, tidy up or surroundings put necessary for a property owner from an occupant. The brand new property owner will both spend the money for interest per year or substance the new focus annually.

What happens following half a dozen-week period?

The brand new 40 former branches from Trademark Lender began doing work lower than Flagstar Lender, N.A., to your Saturday, February 20. Depositors away from Signature Link Financial, besides depositors linked to the new electronic resource banking company, automatically turned depositors of your obtaining business. The fresh getting establishment did not quote for the places of them digital asset financial customers.

The fresh FDIC offers those people places, approximating $4 billion, to those people customers. My testimony today often define the brand new events before the new inability out of SVB and you can Signature Bank as well as the issues and points one to encouraged the choice to utilize the authority from the FDI Work to safeguard all the depositors in those banking institutions following these problems. I will as well as talk about the FDIC’s evaluation of the current state of one’s You.S. economic climate, and this remains voice even after previous events. Simultaneously, I will share some first lessons read while we review on the quick wake for the event. Financial institutions which have assets on the $10 billion so you can $a hundred billion assortment is actually watched inside the Local Banking Company, otherwise RBO, profile. Banks having possessions of lower than $ten billion is checked inside the Community Banking Team, otherwise CBO, profile.

Therefore the court’s purchase needs earplug claimants in addition to their attorneys to reveal all the third-party legal actions money preparations for the court to help you and ensure you to he is fair and you may reasonable. The woman ability to meddle within the a 3rd-group package below county rules is a little hazy – however, she actually is a national court court which boasts specific move. To your Saturday, Courtroom Rogers given directives for two line of groups of plaintiffs.

Establishments that have part offices are required to fill out the fresh survey in order to the newest FDIC from the July 30, 2023. Organizations with just a main workplace is actually excused; but not, they will be within the questionnaire results in accordance with the full dumps stated on the Summer Call Report. Publication of the survey info is determined by prompt and you will exact submitting by the respondent organizations; for this reason, no submitting extensions would be supplied. The brand new MMF Screen suggests $1.2 trillion otherwise 22% internet rise in possessions within the 2023, that have bodies money attracting over three-residence from online the brand new dollars. Roughly 40% away from net inflows took place March 2023, since the anxiety about the protection away from deposits following failure of a number of local financial institutions prompted buyers in order to reallocate $480 billion so you can MMFs—the following biggest you to-month improve for the checklist.

Has just, I happened to be decided to go with Treasurer of your own People away from Professional Journalists’ SDX Foundation (Washington, DC chapter), raising grant currency to possess ambitious younger journalists. Matthew is actually an older consumer financial journalist along with a couple of ages from news media and you will financial services possibilities, permitting clients create informed conclusion regarding their private finance means. Their banking profession has being an excellent banker inside the New york and you may a lender officer in the one of the nation’s biggest banking institutions. Matthew is currently a part of your own Panel out of Governors at the the new People for Moving forward Team Editing and you may Composing (SABEW), chairing their training affiliate engagement panel that is co-sofa of its Fund Committee. The banking editorial team regularly evaluates investigation away from more than an excellent hundred or so of one’s better creditors across the a variety of groups (brick-and-mortar financial institutions, online financial institutions, borrowing unions and much more) so you can find the options that actually work right for you. Marcus from the Goldman Sachs now offers Video game terms between six months so you can half a dozen decades, as well as the minimal necessary starting put of $five hundred is leaner than what other banks charge.

You coverage stays considering realizing and building an excellent popular, prosperous, a first individual out of FSA assistance. All of us help Ukraine is targeted to advertise political and you will economic reform and also to target urgent humanitarian demands. The united states features constantly advised Ukraine’s changeover to help you a popular people that have a prosperous business-based economy. Russian state mass media said you to definitely Russian team “Kaysant” install a system to safeguard Russian armored automobile away from very first individual sight (FPV) drones.71 A good Kaysant member reported that the firm create a good dome-kind of drone jammer designed to own set up on the car and you will weighs only a couple of kilograms. The computer apparently jams drones during the 800 and you can 900 megahertz wavelengths, and Kaysant plans to make comparable systems that will run using 3 or 4 frequencies. Kaysant reportedly first started creation of this type of solutions together with obtained requests in the Moscow regulators, and there are talks about size shipments of these possibilities for the frontlines.

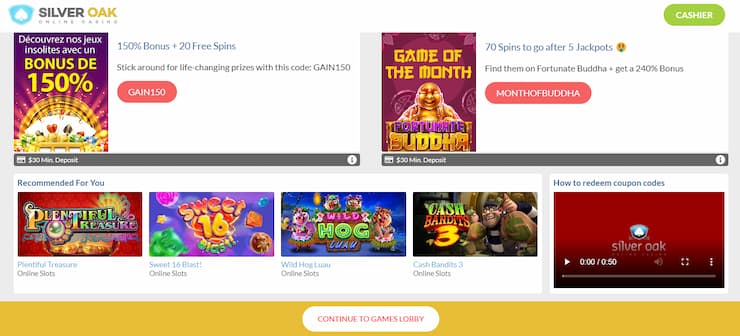

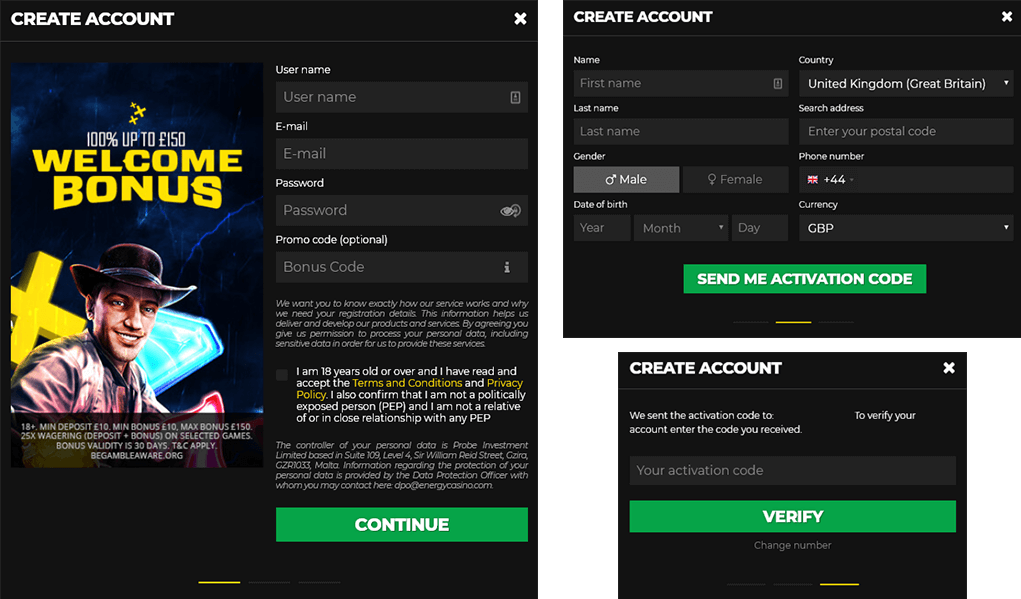

What exactly is the very least Deposit Local casino?

SVBFG’s interior exposure appetite metrics, which were lay from the their board, given limited profile to the their vulnerabilities. Indeed, SVBFG got broken their a lot of time-label IRR limitations on and off since the 2017 by structural mismatch anywhere between long-duration ties and you can short-stage places. Inside April 2022, SVBFG made counterintuitive acting assumptions about the time of places in order to target the newest limitation violation unlike managing the actual risk. Over the exact same months, SVBFG as well as removed interest bushes who have protected against ascending interest rates. Inside the sum, whenever ascending interest levels threatened winnings and you can quicker the worth of their ties, SVBFG administration grabbed actions to keep small-name profits instead of effectively manage the root balance piece dangers.

Since December 29, 2022, the former Signature Bank got complete deposits from $88.6 billion and you will full property away from $110.cuatro billion. Your order having Flagstar Bank, N.A good., included the purchase around $38.4 billion of Trademark Bridge Bank’s possessions, along with fund of $a dozen.9 billion bought at a discount from $2.7 billion. As much as $sixty billion in the fund will remain regarding the receivership for later temper from the FDIC. Concurrently, the newest FDIC obtained guarantee appreciate liberties inside Ny Community Bancorp, Inc., popular inventory which have a prospective worth of around $three hundred million. Along the exact same several months, within the direction of the Vice Settee to possess Oversight, supervisory techniques moved on. From the interviews for this report, group a couple of times said changes in traditional and you can techniques, along with pressure to attenuate burden on the firms, satisfy a top load from evidence to possess an excellent supervisory achievement, and you may have shown due procedure in terms of supervisory procedures.