Founder away from SoCal Va Property

Va Mortgage benefits bring energetic armed forces and Veterans a new chance to realize the top family. As the Virtual assistant mortgage work with turned into obtainable in brand new 1944, more 22 mil Us americans took advantage of the application form. Inspite of the interest in this type of home loans, of several who will get be eligible for that one-of-a-kind financing product cannot explore the possibility of utilizing it!

The advantages of an effective Virtual assistant home loan is actually stretched so you’re able to effective armed forces provider professionals and veterans whom see Va loan criteria. Virtual assistant money provide Significantly more flexible underwriting or any other line of, powerful has actually

While there is no down payment needed or lowest credit rating endurance as satisfied, Pros utilizing their Va financing benefit can also be explore exceptional choices for real estate, and additionally making it possible for home improvements in the act otherwise to get house and creating another type of house.

Although not, not all domestic in the industry have a tendency to qualify for a great Virtual assistant loan. Qualities are needed to end up being move-in in a position, in the place of deferred maintenance, therefore turnkey house should be while using the a traditional approach to financial support a good Virtual assistant mortgage together with your work for.

There are many misunderstandings on Va mortgage positives. Even if they are available owing to a national Guarantee, Va lenders are just provided by personal loan providers individual for earnings organizations, not from Agencies out-of Experts Things. New Virtual assistant doesn’t manage brand new cost, Wall surface Road sooner or later supplies the rates through the securitization process of GNMA ties. These bonds could be the finally place to go for the newest financed Va money as they go into the loan upkeep stage.

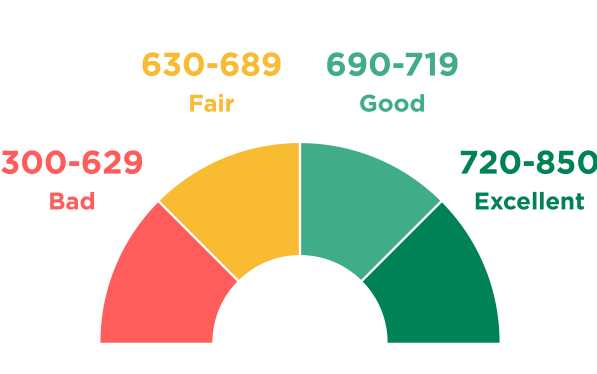

Of numerous is Va individuals think you need a great 620 borrowing get so you’re able to be eligible for an excellent Virtual assistant home loan this is exactly in addition to a familiar misconception. Even Experts that have previous bankruptcies inside their borrowing histories can also be be considered. Many including accept that making use of your Va financing is having first-big date homebuyers. In reality, Va mortgage benefits never expire and can be taken once again getting for every single the newest assets you get, as long as your Virtual assistant mortgage entitlement is also match this new mortgage consult.

Advantages of an excellent Virtual assistant Mortgage compared to Conventional

The key benefits of a beneficial Va financing versus a conventional loan try obvious. This type of benefits fundamentally are offered with the the quantity you to organization buyers need it ties! And organization dealers possess more appetites to own financing produce and exposure might assume to achieve that yield. Let me describe.

Conventional financing score financed and you may securitized using a comparable techniques https://clickcashadvance.com/payday-loans-nc/ just like the Virtual assistant funds. Old-fashioned fund get into securities produced by the us government sponsored businesses FNMA (Fannie mae) otherwise FHLMC (Freddie Mac). That it securitization processes provides the liquidity from the entire financing business. The bucks to cover money will not come from your dumps converted to banking companies.

The reason this action is said is mainly because buyers throughout these bonds (expenditures because of the huge your retirement funds, insurance companies and you can foreign governing bodies) Need certainly to satisfy particular conditions. These grand agencies put money into such substantial Wall Street expenditures, which publish the money on the lenders, exactly who supply the money for you. Actually, that procedure takes place in opposite buy!

On GNMA securities, the latest Virtual assistant Guarantee provides a default backstop which is much better than the conventional mortgage. The standard loan depends on good 20% down-payment otherwise specific amount of financial insurance coverage because a loss protection device. Traders don’t like to reduce currency! When money standard, the possibility of losses was high!

After you stack up the new Individual Requirements as well as their urges to own financial support exposure, new GNMA ties are safer, which possess straight down money output. One to consequently translated to lower mortgage rates for the Va mortgage!

That being said, FNMA and you may GNMA offer a lot higher output than simply 31-Seasons Treasury Ties, but still want certification to meet up securitization conditions. This type of Grand buyers possess finicky appetites, however their cravings translates directly to the new evaluation of Advantages regarding an excellent Va financing compared to Traditional Mortgage: