What’s a decreased put home loan and exactly how will it work for me?

A decreased put mortgage allows you to pick property having a smaller initial fee than just is generally called for. It is of good use if you are looking to find a property but have not secured a giant put. It helps you go into the property markets at some point and commence strengthening equity of your house.

Which are the benefits associated with the lowest put home loan?

They may be such as for example advantageous to own very first-go out home buyers otherwise anyone who has perhaps not been able to help save a hefty deposit.

- Increased use of: Enables more folks to invest in assets eventually because of the reducing the quantity of savings called for upfront.

- Business admission: Lets people to enter the home markets in the latest pricing, probably taking advantage of business gains and you may increasing equity over the years.

- Independence during the offers: Gives the potential to purchase or allocate savings for other needs or financial ventures, in place of solely targeting accumulating a huge put.

- Possible authorities bonuses: clickcashadvance.com personal loan interest rates Tend to entitled to various regulators apps one to help lower put credit, reducing even more can cost you such as for example Loan providers Financial Insurance (LMI).

Which are the disadvantages regarding a mortgage that have a decreased put?

Mortgage brokers having low places renders to find a home a great deal more obtainable, but they are available that have certain change-offs that consumers should consider. These downsides include potential much time-term financial impacts.

- High complete will cost you: That have a smaller first deposit, you can finish credit more and therefore expenses even more focus across the lifetime of the mortgage.

- Lenders Home loan Insurance policies (LMI): Very reduced put finance need you to shell out LMI, and therefore protects the lender but can put a life threatening prices in order to your loan.

- Enhanced monthly obligations: As you are funding a more impressive number, their month-to-month repayments will generally become high as opposed to those of that loan which have a bigger put.

- Possibility negative collateral: In the event the possessions philosophy decrease, you might find on your own owing on the mortgage than the home is well worth, particularly when you have made a smaller put.

- Stricter eligibility conditions: Lenders may impose more strict borrowing from the bank and you will earnings tests to help you offset the danger of a lowered deposit, possibly therefore it is more challenging in order to qualify for the borrowed funds.

Was I eligible for a reduced put home loan having Rapid Loans?

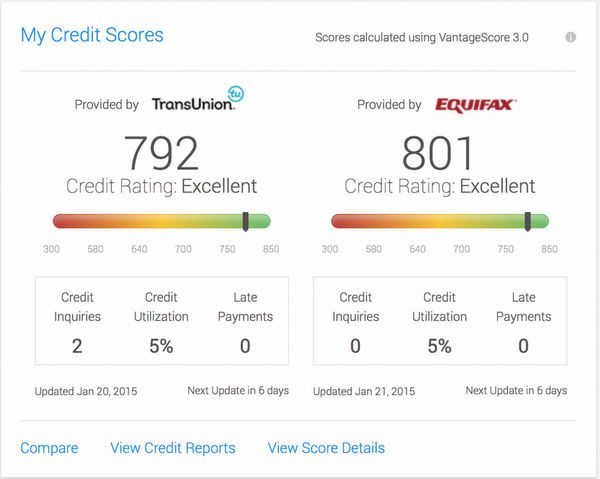

Qualification hinges on multiple facts together with your earnings, credit history, a job condition, other possessions your ount out of put you really have protected. I contemplate Centrelink costs while the earnings below particular conditions.

It’s always best to complete the Free Financial Review, towards the top of this site, to begin, and then we may then feedback your money, requires and needs to help you from the 2nd methods available to you.

At Fast Money, i have more than twenty years expertise coping with people with the categories of issues out of self-a position so you can bad credit histories to help them receive home loans that work for them.

What’s the minimum deposit necessary for a decreased deposit domestic loan within Quick Money?

In the Fast Money, minimal deposit needed for a decreased put financial usually initiate out of 5% of purchase price of the home. However, that it number may differ depending on your individual factors, this financing product, as well as your qualifications significantly less than certain standards.

To help assistance to the purchase, you might be eligible for regulators techniques like the Earliest Household Make certain, Local Family Ensure, or perhaps the Family home Be sure, that may allow you to get property with a level down deposit. This type of applications are designed to reduce the burden to entryway to your the newest housing marketplace, specifically for basic-go out consumers and the ones inside the certain lifestyle situations, particularly single parents. Around this type of plans, the government essentially acts as a good guarantor getting a portion of the loan, potentially getting rid of the need for Lenders Home loan Insurance coverage (LMI) and decreasing the put criteria.