3: Establish your credit

A good credit score allows you to be eligible for a lesser rate of interest. Usually, you want a credit score of at least 620 to help you qualify for a mortgage loan. Insights your credit rating allows you to establish a plan to improve your rating, that will reduce the overall cost of mortgage.

In the event the rating is actually low, you might develop your credit score through applications such as for instance First Fed’s Borrowing Creator Mortgage. The financing Builder Loan makes you invest in a certificate from put (CD) into continues away from a guaranteed mortgage which might be paid over one or two decades. At the conclusion of the time period, you will have mainly based a constant record of payment that will help increase your credit history. Along with, there’ll be an entire coupons with accrued focus regarding the Computer game.

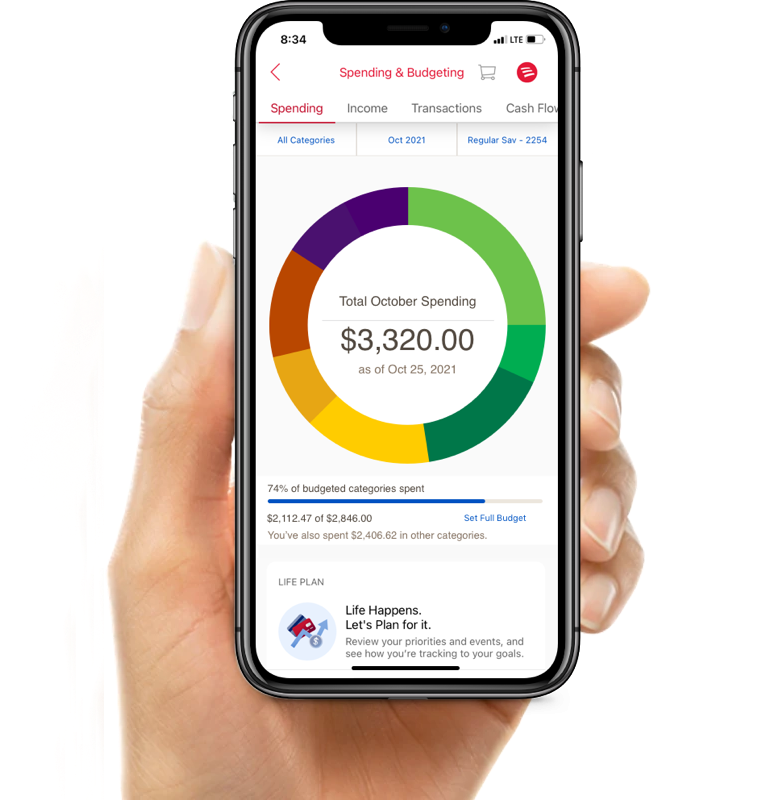

In advance thinking about domiciles, it is important to establish a good finances. The last thing need will be to start looking in the property, love you to, immediately after which find the mortgage is more than you can afford. An initial Fed home loan expert helps you put a cost variety centered on your revenue, debt, amount you have got having a deposit, your credit score, and you will in which you plan to live. Understanding how your income and you can potential debts is underwritten helps promote your a clear picture of what you can qualify for.

Your DTI is your month-to-month financial obligation costs divided by the terrible month-to-month income. This is certainly one method financial institutions use to decide how much your normally borrow. That it calculation is actually equally important on the credit history when looking to qualify for home financing.

As you take all this type of situations into consideration to find the budget you really can afford, do not forget to add even more expenditures such as for instance settlement costs and moving expenditures. These may sound right and you may feel tall when you find yourself for the a great tight budget.

Step 5: Work towards the discounts requires

A good long-identity mission for every single earliest-go out homebuyer is to be sure that monetary security and you may work to your your upcoming saving specifications. https://elitecashadvance.com/personal-loans-or/dallas/ First Given has the benefit of Dvds and you will large produce coupons membership that help you stay on the right track. When you’re hitting their offers goals to suit your brand new home is top out of attention, it is in addition crucial to consider their long-title coupons requirements and later years agreements therefore men and women arrangements aren’t derailed by the get.

Action six: Knowledge assets items

As the an entire-provider lender, Very first Fed mortgage positives helps you navigate the new ins and outs off other property versions to discover the best financial alternatives for the requires. They provide fund for various property items, including:

- Single-Family members Property

- Townhouses

- Apartments

- Multi-Nearest and dearest Home

- Are produced Property

- Land/Loads

- ADUs (Accessory House Products)

- Unique Characteristics

Action eight: Initiate family browse that have experienced realtor

The home-to shop for journey should be a lot of time, and at Earliest Provided, financial experts are along with you every step of your treatment for establish you for success on your own earliest domestic-to order experience. Starting with a lender basic has helping you choose the best real estate professional lover to exhibit your offered households and set together the promote.

With rigorous collection, costs and you may rates rising, working with a first Given lending company due to the fact a first-date house visitors is far more essential than before, so when your offer is approved, you can search forward to a quick and easy closing.

Custom Full Home loan Qualities to have Very first-Date Consumers

First-go out home buyers on Pacific Northwest deal with a strong homes market and you may competition for every checklist. Rather than anywhere else in the united states, more folks are transferring to Washington getting high-investing jobs and its particular beautiful beauty. Because houses sales draws of several earliest-big date home buyers, becoming wishing is essential.