To the growth in the fresh new economic business, many banking institutions and you may NFBCs have to offer different varieties of funds. The kind of financing you have made depends on your requirements. This article will take you step-by-step through two types of funds -a training financing and you can an interest rate -in addition to their differences.

A knowledge loan try a consumer loan lent to finance large training. At exactly the same time, a mortgage was a guaranteed mortgage considering up against security and you will are used for various motives such as for example financing your newborns training, renovating your property, an such like. Keep reading to understand exactly how these two funds disagree.

step one. Meaning

An interest rate is a kind of covered mortgage giving money in exchange for a keen immovable advantage, eg a property or a bit of a property. If you don’t repay the mortgage, your bank often keep so it asset because the guarantee. It is an agreement ranging from you and your financial, for which you render accept the brand new lender’s right to repossess the advantage if you’re unable to pay-off the loan.

A studies financing try a consumer loan, for example it’s been provided without having any equity within the replace. It is a sum of cash that’s lent to cover degree costs. Many financial institutions and you will NFBCs offer training funds to school-heading students.

dos. Need

- Resource an unexpected scientific you want

- Buying the greater knowledge of your people

- Spending money on the wedding of the people

- Broadening your organization

- Renovating a home

As well, you should use the sum of the a knowledge financing only to pay money for your university fees fee or any other instructional expenses.

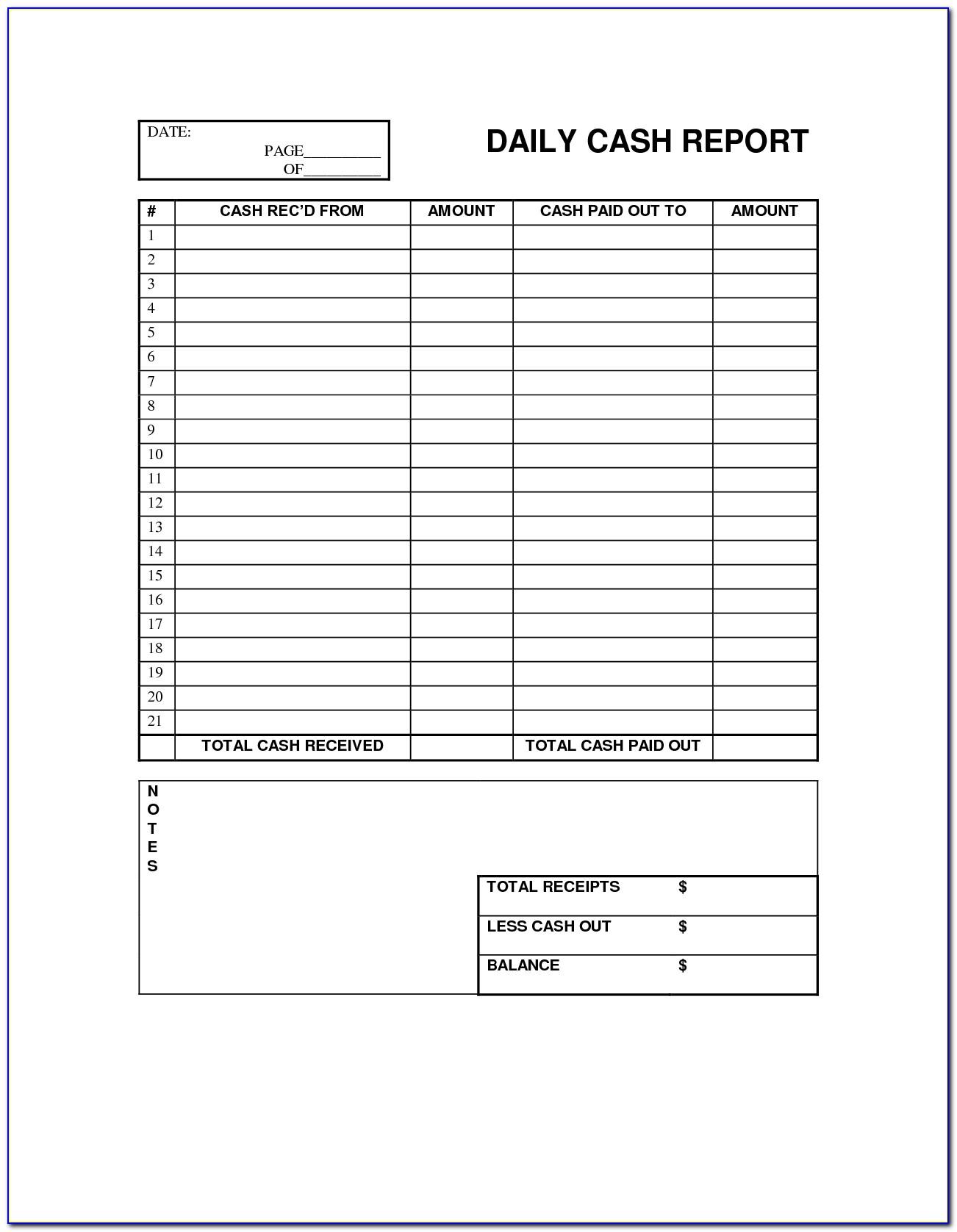

step three. Loan-to-Value Ratio

Extent you have made out-of a loan when compared to the genuine property value property (guarantee for a mortgage loan ) and you may way charges (to own a training loan ) is named the loan-to-worthy of ratio.

Usually, banks and you may paydayloansconnecticut.com/lakeside-woods NFBCs offer sixty%-70% of property’s market price when you look at the an interest rate. Regarding degree finance , lenders provide the debtor to the complete sum you to definitely looking for its education might need. The new fees may tend to be university fees costs, rooms costs, etcetera.

cuatro. Repayment Schedule

In both a mortgage loan and you may a degree financing , you only pay the borrowed funds number back in the type of EMIs. The latest EMI amount can be decided ahead. In most cases, banking companies strongly recommend you the best EMI count according to the monthly income. But you can also discuss this new EMI number depending on your fees function.

When you look at the a mortgage , this new fees plan begins whenever the amount borrowed are gone to live in your inserted family savings. For instance, for folks who took a loan beforehand otherwise center out-of the fresh month, the bank usually place a date throughout the pursuing the times to have new EMI costs.

Nevertheless the borrower from a degree financing are a student having no income source. That’s why the fresh fees is set to start following the course conclusion which the borrowed funds was taken. Together with, lenders do not request cost right after the course end; rather, they offer half a year sophistication several months to track down a career. When you find employment inside the sophistication several months, new installment cycle initiate owing to EMI. If good salaried person chooses to have a training financing , brand new fees plan matches to own a mortgage loan .

5. Cost Tenure

This new payment period getting an interest rate can move up in order to 15 years, since they’re provided against collateral. To have studies funds , new tenure increases to eight decades. But the period varies from bank so you can financial.

six. Disbursal away from Amount borrowed

To possess mortgages , lenders disburse the mortgage matter on borrower’s inserted financial account pursuing the recognition of loan. Together with borrower is free is use that share for your purpose.

In the case of degree funds, the loan amount is not privately paid into the debtor or transferred to the family savings. As an alternative, the lenders import the loan count right to the fresh new account regarding the training place where they will certainly data.

eight. Income tax Work with

Considering Part 24(B) of the Taxation Act , salaried somebody will benefit about income tax deduction to possess home loan fund (also known as money against assets). If you utilize the borrowed funds total money yet another house or home restoration, you may want to file for a taxation go back of up to ?2 lacs you paid because financing notice.

Whenever you begin making costs to have an education loan , you need to use Part 80E of Income tax Operate so you can allege good deduction regarding the desire you pay per month. However, the deduction is not welcome into the dominant costs.

Benefits associated with Obtaining financing within Piramal Money

- Virtually no charges for property foreclosure and very early payments

- Restricted documentation

- Effortless processes which have brief approvals and you may disbursals

- Reasonable month-to-month EMIs

Completion

One another mortgage loans and you may education finance suffice various other purposes. If you would like purchase their degree in the India otherwise overseas, get a training loan. You can get and will not you want security. not, opt for a mortgage loan when you need to money a keen urgent scientific expenses, buy your wedding day, grow your providers, otherwise upgrade your home.

Locate that loan away from Piramal Fund, apply right here otherwise name 1800 266 644. Which have Piramal Money, you can be certain away from customised customer support and customised mortgage plans. You could check out almost every other such as for instance articles and you will borrowing products and services on their website.